The ultimate face-off between two heavyweight champs of the cladding game: Stucco and Siding. We’re diving...

How To Be A Killer Successful Businessman – Multi-Millionaire’s 100 Laws On Murdering Entrepreneurship

Business: It’s war disguised as commerce. A campaign of stamina against time itself, where trophies are balance sheets and bodies are bankruptcies.

This is not a sermon about hustle or gratitude journals; it’s a manual for conquest. Marcus Aurelius called commerce “a mutual deception for gain.” He was polite. The truth is sharper: only one side leaves the table richer.

The successful businessman doesn’t seek motivation, rather, he seeks to conquer himself and his world along the way. He’s would rather die building than live climbing another man’s ladder. The process is his end reward.

The average male entrepreneur petitions the marketplace like a priest begging gods of venture capital. The killer builds until heaven takes notice, and the universe has no choice but to bend to his will. He doesn’t launch a company… he opens a front line in a global civil war of profit. Time, energy, and reputation are his only coins, and he spends them like a king burning his ships. There is no going back.

Work-life balance? Fictional comfort for the domesticated. Ask any multi-millionaire or billion about purpose in relation to work-life balance… Do it, I dare you.

To be a successful businessman at this altitude, you cease to be a citizen. You become an architecture of purpose: part machine, part priest, part predator. As Napoleon said, “A man does not have himself truly until he risks himself in battle.” Business is that battle; run to the gunfire.

Reality. The market is godless. It does not care for the stories told at your funeral. It rewards sacrifice the way generals reward courage. It punishes hesitation like treason. Results, not sincerity, are the only morality the indifference of nature respects. You don’t have to like the rules of the game. You only have to understand them, master them, and make them serve you.

Blood. Power demands sacrifice. Friends, comfort, and sleep are the first tributes. If you crave reassurance, stay employed. If you crave validation, buy therapy. As Carnegie wrote, “The man who dies rich dies disgraced.” The killer finds serenity in stress, fortune in volatility, and sanctuary in chaos. He becomes fluent in pain until pain submits.

Narrative. Business is theatre where truth rents its costume. Every brand, tone, and sentence is propaganda for dominance. You sell the illusion first, then deliver until the illusion hardens into reality. When reality catches up, you invent a new illusion. It’s how Rockefeller sold oil and Jobs sold magic. Control the narrative, and you control belief. Control belief, and price bends to your name.

These 100 laws on how to be a successful businessman are not quotes to tape over a desk. They are operating code stolen from the ledgers of the world’s greatest men who bent nations for quarterly gain. Read this as scripture. Each line an order.

Don’t wait for clarify. Build, borrow, and cleverly conqueror… sometimes politely enough for lawyers to applaud.

By the last law, you will either recognize the architecture of your own ambition, or discover you were never engineered for empire. High performance super success isn’t for every man… you either have fire in your blood or you don’t. The world still runs on the hands of doctors, craftsmen, and builders. Do not curse the man who serves, as he makes civilization possible. Choose your place in the world with clarity, and live it without apology.

How To Be A Killer Successful Businessman – Multi-Millionaire’s 100 Laws On Building Empires and Murdering Entrepreneurship

How Real Wealth Is Actually Made: Leverage is the ancient art of multiplication. Profit, in its highest form, is never earned by the man who insists on doing everything with his own two hands. That path belongs to artisans, poets, and penniless. True wealth is assembled the way Lorenzo de’ Medici built Florence, by orchestrating resources that belong to other people. Capital (other people’s money) is a draft horse, labor (other people’s time) is a legion, and distribution (other people’s sales effort) is the wind. The man who attempts to stitch shoes alone becomes a curiosity in a museum. The man who commands the factory of a thousand workers, the transport routes, and the market demand becomes an institution. And institutions are paid long after the founder sleeps. If he is wise, he structures the business so that its heartbeat continues absent his own, the way a dynasty continues whether the patriarch is hunting, governing, or dead. Anything less is merely self‑employment disguised as ambition.

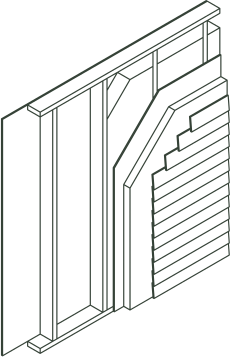

There are five gates through which substantial business wealth enters a man’s life: One may offer a service so distinctively rare, highly specialized, and so indispensable, that the market pays tribute simply to secure his presence. Second, he may locate a precious commodity, acquire it in suffocating volume, and the price becomes whatever his decree… as Jay Gould demonstrated when he strangled the gold market. Third, he may command such overwhelming volume that even the thinnest margin, repeated across a vast tide of transactions, swells into a formidable fortune: whether it flows from cheap hardware screws sold by the handful or from costly windows installed by the dozens in every home. Manufacturing is how he harnesses the labor of others at scale: the factory hands who shape the product, the haulers who move it, the sellers who persuade the reluctant, and the service crews who maintain the aftermath. Every link in the chain is another man’s effort enlisted in his design. But it reaches far beyond manufacturing: consider the legions in healthcare, plumbing, electrical, HVAC, automobile dealerships, mining, etc. all of them operating through disciplined coordination, their collective effort powering the enterprise while the owner’s hands remain untouched by the labor itself.

In our era, the internet has granted a reach once reserved for empires. A single creator can broadcast to entire nations, turning digital streams into millions of paid impressions, while writers who publish a solitary piece can command vast subscriber legions for years. It’s proof that scale no longer requires factories, only a signal powerful enough to travel unchecked through the wires.

The fourth gate opens only for those who build enterprises that the affluent themselves covet: companies polished into acquisition targets, rolled into portfolios, or handed to private investment houses who pay handsomely for the privilege of owning your architecture. The final gate is the most powerful: Debt. Capital as chains. The timid often clutch assets as if they were relics of divine safety; they mistake possession for power and confuse holding for commanding. Any financier with a spine knows the opposite is true: liability, properly harnessed, becomes a bridle on another man’s momentum. When you direct the flow of borrowed capital, you dictate reality itself.

As for the caliber of wealth, men confuse the categories. “Good enough” is not serious wealth, it is simply good enough. There is income that warms the household: pleasant, respectable, and the kind Benjamin Disraeli once called “the comfort of the provincial gentleman.” And then there is capital that influences markets, restructures industries, and exits into the waiting arms of private equity. That latter category demands one of three roads: mastery so rare it borders on sorcery, volume so vast it resembles a continental current, or clientele so affluent that a single transaction rivals another man’s annual ambition. If the machine can be sold whole, management, margins, momentum, then you have built something that financiers will court with the same hunger conquistadors once reserved for gold.

Obliterate Work‑Life Balance: Balance is the vocabulary of mediocrity and an excuse for lack of purpose. It’s a doctrine written by tired men explaining why their dreams never left the drawing board. To build anything that endures, you must exile comfort and court obsession. Vanderbilt, Carnegie, and Rhodes didn’t “balance.” They worked until their signatures bent nations. Napoleon wrote, “If you want a thing done well, do it yourself,” and then slept three hours a night because conquest does not clock out.

High performance business men don’t pause for birthdays, holidays, or vacation reservations. Time is the only currency that dies in your pocket if unspent. Every hour redirected toward leisure is a withdrawal from empire. True businessmen are monastic creatures… half‐worshipper, half‐machine… who blur the line between personal life and professional immortality. As Marcus Aurelius warned, “A man’s worth is no greater than his ambitions.” Ambition that stops for weekends is counterfeit.

Your family, your health, your happiness: these are management problems, not excuses. Structure them around the mission like provinces under an emperor. Work‑life balance is the mythology the unsuccessful tell the unborn to slow them down. Erase it. Replace it with calibrated intensity. Either you live inside your business, or one day you work inside someone else’s.

You’ll hear every flavor of surrender dressed as balance: ‘Well I need to have a life too.’ ‘When the kids sleep through the night.’ ‘After the promotion.’ ‘I’ll start Monday.’ ‘Once I’m done with this Netflix series.’ ‘When things slow down at the office.’ ‘After my vacation.’ ‘Once I get over this cold.’ ‘Only if it’s after my golf lesson but between my dentist appointment on Thursday.’ ‘After the next election.’ All lies. Every sentence is a shovel, digging your own mediocrity a little deeper.

Smell the Leather: A man cannot covet what he has never touched. Ambition is a sensory act. Go sit in the back seat of a Rolls‑Royce and inhale the arrogance of stitched leather. Walk the marble halls of the Biltmore Estate or the Palace of Versailles and remind yourself that human hands built cathedrals for ONE family’s comfort. Reserve a dinner at the finest restaurant you can barely afford. Every touchpoint trains your nervous system to reject smallness. Genghis Khan rode through conquered palaces so his soldiers understood what they would own next.

Set weekends aside not for rest but reconnaissance. Tour private airfields, luxury real‑estate showings, supercar dealerships, and the museums of empires long extinct. Observe cost not with envy but with calculation. Oscar Wilde wrote, “To expect the unexpected shows a thoroughly modern intellect.” Expect greatness so vividly that its absence reeks. When you feel genuine discomfort for not being able to excellence, you’ve met the start of your future. Every empire begins with one audacious afternoon spent pretending you already own the world, and refusing to apologize for the rehearsal.

Lawyers, bankers, accountants, etc. most will meet you once for free, because confidence sells curiosity. Walk into their offices. Dress presidential. “Fortune favors the prepared mind,” said Pasteur, but it also bows to those who look prepared. Wear what success requires: a tailored suit. Carry yourself as the enterprise you intend to build. When you look expensive, people assume your time is too, and they start treating it as reality. Belief begins in perception, not only the world’s but your own. The world invests in the image before it audits the numbers. Wear the future until it fits.

Nobody Cares, Win Anyway: The first delusion to kill is that anyone is watching. They’re not. The market isn’t your mother… it doesn’t clap when you try. You can build the finest product on Earth, engineered perfection, flawless service, and everything and then some, but if the buyer already golfs with someone else, you don’t exist. Even free won’t move them: “free” only works when it’s bait for something more expensive. That’s why (allegedly) McDonald’s gives toys and Walmart bleeds on pricing. It’s not generosity, it’s war bait. You think passion will save you? Passion without profit is ego-stroking. Validate your vision fast or bury it. As Franklin wrote, “He that waits upon Fortune is never sure of a dinner.” No one cares if you’re talented, broke, late, fired, or noble.

Everyone is drowning in their own survival, praying their own numbers stay black. You are invisible until you force proof onto their radar. So stop asking for recognition. Build something loud enough to interrupt self‑interest. Be ruthless with evidence. When empathy dies, efficiency begins. The market will notice only after it must, aka when ignoring you costs it money. Until then, act like a ghost with a sword: unseen, unpraised, but lethal in every movement. That’s how you win in a world too busy to care. Don’t delude yourself that friends or family will buy, share, or promote you; the fantasy of support dies the moment money enters the room. Stop whining and start being a warrior.

Positioning To Get Lucky Triumphs Hard Work : The marketplace is packed with men grinding themselves into dust. Dirty money, clean hands… They clock a thousand hours a week, worshiping effort like a religion that never answers prayer. Hard work is the floor, not the ceiling. Every mule works hard; only few own the carriage. You can toil indefinitely and still vanish because the world rewards leverage, not labor. Napoleon observed that luck often favors the bold, but in commerce it favors the visible, the connected, the ready. Half the tycoons you idolize were born with equity in their bloodstreams: grandfathers with oil fields, fathers with venture capital, networks seeded before they spoke. That’s not cynicism; it’s geography. Some men are born on the hill… others must break rocks and build their own climb.Your mandate is positioning. Luck is not mystical: it’s a collision between competence and exposure. You cannot summon miracles from the couch. Work creates situations where fortune can visit: a business open for acquisition, an idea timed with crisis, a handshake that lands in history’s photograph. The lazy man prays for the wind… the sovereign raises the sail before the storm. You play to win or you play to by being present. As Seneca said, “Luck is what happens when preparation meets opportunity.”

Attention Is Currency: In the modern arena, attention is the only legal tender left. Everything else: product, quality, and ethics, is ornamental until the spotlight hits it. You can craft the most brilliant invention since fire, but if no one sees the flame, you freeze with it. The graveyard of startups is filled with perfect products that no one noticed. Attention is hierarchy: whoever commands the gaze commands the gold.

Alexander built empires not solely by conquest but by spectacle: his wars were theater for reputation, and the world applauded itself into submission. So treat visibility like oxygen. Your emotionally compelling copywriting is worthless without eyes to bleed on it. Your pizza empire, no matter how world-class the pie is, is a tomb without customers. The naïve believe that merit attracts traffic. The successful business man has to engineer it. Every click, headline, rumor, and controversy is a battlefield skirmish. You either manufacture attention or become another invisible craftsman building masterpieces for a blind audience. In business, obscurity is death.

Bloodlines and Access Matter: Accept that it’s never fair. The ladder isn’t the same height for everyone. Many of the names etched in gold were carried there by inheritance, not invention. Empires built on “vision” were often financed by lineage… billionaire fathers underwriting risk, uncles signing guarantees, old‑money banks lending on surname alone. Certain circles borrow at zero while you desperately accept ten percent; their handshake replaces your collateral. That’s not injustice, that’s infrastructure. Don’t waste rage on it, it doesn’t compound. You are not the heir, you’re the insurgent. The world favors the networked, so build your own. Claw upward through proof, performance, and precision until access becomes irrelevant. Every outsider who wins writes a manual their betters can’t copy. As Disraeli said, “The secret of success is constancy to purpose.” They inherited permission, you will purchase it in blood. The cost is unfair. Pay it anyway.

The Psychology of Purchasing: The customer’s mind is not a marketplace of logic but a battlefield ruled by impulses older than commerce itself. The philosophers of decision: Kahneman with his dual‑system mind, Thaler with his behavioral nudges, and Ariely with his catalog of irrationality: each revealed a truth merchants have sensed since the bazaars of Carthage: men do not buy because they understand; they buy because they feel. And chief among these feelings is fear: fear of choosing poorly, fear of missing out, and fear of falling behind a tribe they want desperately to impress. The more primitive the fear, the more elegantly it guides the hand toward purchase. Even modern advertisements, disguised in the friendly tones of jingles and cartoon mascots, operate on an ancient grammar: they show vitality to chase away decline, belonging to silence loneliness, and excitement to disguise routine. The successful businessman as the seller recognizes this pattern not to exploit it, but to interpret it, the way a seasoned diplomat reads the tremor behind a ruler’s smile. A weak salesman drowns his prospect in features, while a disciplined one speaks directly to the hidden tension driving the entire encounter.

Yet emotion alone is not the whole engine. Choice architecture, the domain of Cialdini, Bernays, and the lesser‑known masters of public persuasion, teaches that people decide through association long before they decide through analysis. A customer facing a trivial purchase may still be moved by identity: the unconscious desire to appear competent, adventurous, youthful, or wise. Even the most innocent marketing, whether a billboard of exuberant children or a neatly staged supermarket display, signals a version of life the buyer wishes to inhabit. And here lies the tactical discipline: the seller must articulate value in a way that aligns with that aspirational self‑portrait without distorting truth. He must maintain posture: slow speech, steady rhythm, and open stance posture indicating that he is offering clarity, rather than confusion. If he rushes, oversells, or litters his tone with nervous qualifiers, he communicates insecurity, and insecurity breaks trust. The businessman as a persuader illuminates the stakes of the decision with the sharpness of a scholar who has read both Freud’s theories of desire and Seneca’s warnings about self‑deception. He reveals the emotional forces already shaping the prospect’s thoughts, granting him the dignity of an informed choice. In doing so, he elevates persuasion from manipulation to mastery.

Dream Big, Think Big Beyond Your Wildest Expectations: Growth begins the moment comfort dies. Every inch of progress is paid for in fear, friction, and risk. If you wake without nerves, you’ve stopped climbing. Theodore Roosevelt trained courage by forcing himself into the things that terrified him, he called it “the arena,” where a man’s mettle is either proven or melted. Follow his drill: name the act that frightens you most and do it before noon. Repeat until fear becomes an appetizer. Your goals should mock logic; they should be so vast that even failure lands you above normal men. Michelangelo warned, “The greatest danger for most of us lies not in setting our aim too high and falling short, but in setting it too low and reaching it.” A man who dreams beyond reach guarantees movement; a man who dreams within reach guarantees stagnation.

Set objectives no lifetime could finish. Play to win by a landslide. Build empires that outlive your wildest dreams or expectations. Multiply every aim by ten fold until it embarrasses you, because embarrassment is ambition’s compass. And remember, the market evolves like a predator: customers demand faster, better, and cheaper every dusk. The Hunchback asking Marilyn Monroe out wasn’t foolish, it was progress. Seek what terrifies you daily.

No Business Plan, Only The Pitch: Most beginners arrive at a lender’s desk armed with elaborate documents, as if ornamentation could substitute for conviction. Do not bring a business plan to the first meeting; you do not need a business plan to get financing. Let the banker show you what an approved proposal looks like. Request a sanitized copy of one they have already financed. That document becomes your template, crafted by their own internal logic rather than your imagination. Business plans themselves are speculative theatre, and even Adam Smith admitted that projections are merely “conjectures wrapped in confidence.” Treat them as sketches, not scripture. The truth is simple: your estimation of required capital is almost certainly wrong, and the lenders know this. They are evaluating you, not your spreadsheets.

To pitch well is to: Convey the essence of your idea in ninety seconds. Articulate why you are the engine capable of executing it. And then, master your numbers. Not approximately. Not philosophically. With precision. Many founders collapse when questioned because they memorized enthusiasm, not mathematics. Before any formal pitch, rehearse with a hostile audience who interrupts, challenges, and mocks your assumptions. If your idea survives combat, it will survive the bank and investor PowerPoint presentation.

Borrow More Than You Think, Way More: Borrow so much that your creditors become structurally dependent on your survival. There is a primitive superstition among small business owners: they believe restraint in borrowing is a virtue. It is not. It is merely fear dressed as fiscal prudence. The successful businessman borrows with strategic indifference to modest sums because small capital cannot bend markets, cannot scale velocity, and cannot absorb miscalculation. Rockefeller built Standard Oil not by timidity, but by securing capital wide enough to swallow entire competitors when they stumbled. You must adopt the same arithmetic: the number you think you need is nothing more than a polite fantasy. Ask for multiples, not because you intend waste, but because you intend inevitability. Keynes warned that economic plans collapse not from malice, but from undercapitalization. You cure that disease with excess, not austerity.Small fluctuations in rate, one point, three points, five, etc., whatever, should not concern you. If such variations threaten the deal, the entire architecture was unfit for empire-building. A real deal is constructed with the depth to endure economic weather, political turbulence, operational mistakes, and human frailty. You engineer margin the way ironworkers engineered the Eiffel Tower, redundant, overbuilt, and unapologetically durable. Before accepting any credit facility, run a “collapse inversion”: assume worst-case burn, maximal delays, supplier failures, litigation overhang, and stress the financing against every catastrophe that has destroyed lesser men.

Debt is not a burden, it is a tool. It compresses time. It magnifies scale. It grants the borrower inevitability over unleveraged rivals moving with the slow circulation of their own cash. As J.P. Morgan once said, “A man always has two reasons: the good one, and the real one.” Your good reason for borrowing may be growth, the real reason is dominance.

Investigate Your Market: To decipher a market is to perform a kind of economic reconnaissance… charting not the banners companies wave, but the thresholds that determine whether a newcomer survives the campaign or dies in the first skirmish. Every industry hides a minimum share required for stability: some demand a quarter of the battlefield before a contender can even sharpen his sword, while others require only a sliver. A wise strategist measures these invisible borders long before he deploys resources. In certain businesses, like carbonated beverages, profitability only awakens once a house commands roughly twenty‑five percent of the domain. It’s a slow siege measured in decades. Phones demand nearer ten to fifteen percent, but their gates open at a crawl, with newcomers advancing scarcely half a percent per annum. Automobiles, however, shift with surprising fluidity. A disciplined entrant can capture two percent, the line of viability, with a pace that rivals Alexander’s rapid conquests. The tempo of market share acquisition is not trivia; it is a direct measurement of the incumbent’s fortifications. The slower the march, the more entrenched the throne.

Yet some kingdoms cannot be breached at all. Certain sectors function as natural monopolies, not by decree, but by gravitational pull. The titan of search, for example, holds its crown not through brute force, but through an ecosystem so self‑reinforcing that even lavishly funded challengers sink beneath its weight. To enter such a domain is not bravery; it is misreading the terrain. More nuanced markets, like soft drinks, punish the unprepared differently: they are technically penetrable but require such colossal investment in distribution, sentiment, and brand permanence that only the patient or the foolish dare attempt it. The successful businessman studies all this with the detachment of a seasoned general: quantify the threshold of survival, measure the velocity at which contenders historically rise, and inspect the incumbent’s moat for signs of erosion. The amateur charges forward because he “likes the industry”; the master advances only when the mathematics of the battlefield whisper that conquest is possible.

Your Credit Doesn’t Even Matter: A man who hides behind his credit score is not protecting himself… he is confessing that he wishes the world would excuse him from combat. Financiers have always preferred borrowers with a catalog of completed ventures. Cicero himself remarked that “past performance is the usurer’s only oracle.” A banker, like any risk‑sensing animal, leans toward the individual who has marched through several campaigns without falling on his sword. If you lack such a record, that is not tragedy, it is the price of admission. Borrow the lineage of someone who has walked that path. The amateur panics at the thought of sacrificing equity during his first acquisition, while the successful businessman understands that one early concession becomes the key that unlocks the second, the third, the tenth. What the inexperienced fool does instead is drag in a relative with the same surname and the same shallow pedigree, believing familial proximity substitutes for credibility. Enlightened lenders recoil at such pairings because they smell of desperation, not governance. They prefer a page of signatures bearing different histories, not the in‑laws gathered around a table like anxious spectators.

When seeking capital, the sovereign man conducts reconnaissance. A newly merged bank is often disoriented, eager to prove its relevance, and therefore more receptive to proposals others would decline. A new branch, still polishing its marble, may grant audience where the established houses would scoff. And only the provincial assume America is the sole arena for credit: the world is wider, and certain foreign institutions concern themselves with opportunity, not your domestic blemishes. If you must cross an ocean or sit upright on a ferry to present your case, then that is the pilgrimage required.

Even multiple credit inquiries barely register to institutions who judge by narrative coherence, not bureaucratic superstition. All the credit scars: delinquencies, judgments, the whole unsightly parade, do not bar a man from acquiring a company. In reality, they only require a different architecture of leverage. In such cases, you enlist a guarantor, a steady hand whose balance sheet can withstand the banker’s scrutiny. Offer this ally a measured slice of equity, ten to fifteen percent, while making it clear that no cash is demanded from them, only the gravity of their signature. Once this spine is in place, you approach the seller with a structure that satisfies the SBA: a down payment of only ten percent. Half of that contribution can emerge from the seller himself if he agrees to treat a portion of the price as equity.

Then there are the patrons of old money: angel investors who will finance your ascent (at 90% of the deal) if you demonstrate competence, and who will strip you of your crown if, within a year, you fail to rule the enterprise you acquired. Many pretend they can serve in such a role, most businessmen cannot.

Show that you are willing to endanger your own comfort… to put your own assets, your reputation, your hours, and your composure on the line. For no banker will champion a man who seeks safety above stake. And remember, lenders are not your only battlefield: seller financing exists, often motivated by the grinding tragedies of life: a spouse’s sudden illness, a family crisis, or a medical catastrophe forces the owner to liquidate what he spent decades building because time, not valuation, becomes the scarce resource. But such opportunities bow only to the man who asks. Silence is the true barrier to capital, not credit. Hesitation is the enemy, not the banker.

To strengthen your appeal, present immaculate financial statements, signed by auditors whose names cause boardrooms to straighten: Deloitte, PwC (PricewaterhouseCoopers), EY (Ernst & Young), KPMG.

Ask For Forgiveness, Then Permission: The businessman who waits for permission has already declared himself subordinate. In business, as in statecraft, initiative is the decisive weapon. Provided, of course, that the strike remains within the boundaries of law, ethics, and one’s own moral code of honor. The timid request approval before moving. The effective businessman moves first and presents results later, knowing that success has a remarkable talent for laundering transgressions that harmed no one. As Francis Bacon observed, “boldness is ever blind,” but hesitation is fatal. In commerce, paralysis is the sin that accountants cannot record, yet it destroys more ventures than debt ever did. Seek forgiveness only when the deed was noble, and seek permission only when you intend to achieve nothing.

Modern corporations chant “think outside the box” with the same sincerity that courtiers once praised kings they secretly feared. The slogan is paraded in employee handbooks, yet any soul who attempts genuine innovation finds himself entangled in the soft tyranny of corporate etiquette. You know, the committees, HR sermons, and the delicate sensibilities of those who mistake fragility for virtue. In such climates, original thought becomes a contraband substance. The successful businessman therefore learns to cloak his ingenuity: he presents bold action as procedural necessity, he frames deviation as inevitable adaptation, and he ensures that when results arrive, even the most politically cautious spectator is forced to applaud. The fool asks whether the box exists; you simply walk past it and let the room catch up.

Remember the Old Law of Power: substantial capital purchases insulation: the caliber of counsel, intermediaries, and influence that turns potential storms into mere administrative breezes.

Take Everything and Always Want More: I say this with calculation: leave the world stronger than you found it, or your existence becomes subtraction. A brief vandalism on mankind’s ledger is worth nothing and remembered less. Contentment is the vocabulary of decline. The successful businessman knows that expansion is existence and stasis is rot. He takes everything within reach, not from greed, but from arithmetic: if you don’t, someone worse will. Carnegie called it “the gospel of wealth,” the sacred duty of accumulation, where possession equals protection. You push because walls close behind you. You consume because markets perish when left unfed. Wanting more isn’t sin, it’s oxygen for creation. Every empire falls the moment its builder decides he has enough. So keep companies, cities, and even decades under acquisition. Let appetite be your compass. Let conquest be your metabolism. The man who takes everything ensures the next man has nothing left to take. You either outmaneuver your rivals until their lights go dark, or they extinguish yours. The market does not honor politeness, only victory.

Ideas Mean Nothing Without Action: A man may possess a mind rich enough to rival the libraries of Alexandria, yet every idea he holds is worthless until dragged into daylight by action. You stand upon acres of diamonds, not metaphorically, but structurally: a field of potential buried beneath your own hesitation. The mind produces concepts endlessly, but unless you dig, refine, and weaponize them, they remain geological trivia. As Denis Diderot once muttered in frustration, “Genius without execution is a statute without a nation.” Invent something brilliant and fail to patent it, and your competitor will. Uncover a market gap and refrain from pitching it, and the capital will flow to the man who dared where you dallied. Even the simplest spark, the absurd toy, the trivial household device, the cheap novelty, etc. can become a fortune if acted upon. Slinging mud onto a cardboard wall once birthed the Slinky: a bored chemist created Silly Putty by accident and sold millions. They weren’t prophets. They were doers. Embarrassment disguises itself as caution, fear masquerades as prudence, and unmotivated minds call their inertia “timing.”

If ridicule of your idea frightens you, remember what Schopenhauer warned: “Every truth passes through ridicule before reverence.” Rejections, sneers, sideways glances, these are simply the tolls charged at the gate of creation. Failure to act is the only real failure. Write the idea. Prototype the product. Pitch the investor. File the paperwork. If you require momentum, create it by brute force: set a 24‑hour rule to transform concept into a tangible step, however rough. No harvest comes to the man who treasures seeds in a drawer and calls himself a farmer.

Speed Forgives Imperfection: Delay costs kingdoms. Perfection is delay dressed as virtue. Every empire begins ugly and unfinished. Men waste years word‑smithing slogans, polishing logos, and waiting for credentials no one will ever check. The market doesn’t reward immaculate, it rewards immediate. Caesar didn’t cross the Rubicon when it was convenient, rather, he crossed when it mattered, and history forgave the mess. You stop polishing and start moving because motion compounds faster than mastery. Every day without launch costs you more than any flaw ever could. Automate repetition, carve priorities, and strike before your certainty decays. As Goethe said, “Boldness has genius, power, and magic in it.” The slow man refines plans, the fast man rewrites the world before the ink dries. Speed absolves imperfection the way victory absolves sin… once you win, no one remembers the typos.

Eagles Fly Alone: Greatness doesn’t grow in flocks. You hunt in silence. The higher you ascend, the thinner the air and the fewer the voices that can breathe it. The man chasing immortality spends his nights refining systems, not watching the game with drunk companions mistaking routine for joy. “Whosoever delights in solitude,” wrote Francis Bacon, “is either a wild beast or a god.” The entrepreneur becomes both, beast for survival and god for creation. Look at Branson, Gates, Musk, the rest… if they attend events, it’s to network, not to escape.

You are the sum of the five ambitions nearest you, not the five excuses. Every pint wasted with the aimless is an empire delayed. Time is the only asset that bleeds until you run out of it; treat company as an investment, not therapy. Eagles don’t mingle with pigeons. They rise until even the noise below becomes irrelevant. Be ready to meet your final hour surrounded not by companions, but by the quiet machinery of your own dominion. Great fortunes erect walls higher than affection can climb; the architect of an empire learns early that legacy demands precedence over sentiment. Once your coffers swell, every acquaintance becomes an applicant, every handshake a request in disguise, and every embrace a negotiation clothed as loyalty.

Burn Your Ships: Security is the enemy of greatness. Every backup plan gives you easy permission to quit, and rest assured, you will take the least path of resistance. The man who keeps an escape route has already decided which door he’ll run through when pressure rises. Julius Caesar proved it crossing the Channel: his first invasion limped home, his second succeeded because he left no transport for retreat. When the ships vanished, hesitation died with them. Alexander ordered the same; his soldiers, stripped of safety, discovered a level of savage focus no comfort could buy. The lesson is identical in business: delete the “plan B.” Every dollar, contact, and sleepless night must be tethered to one outcome: advance or perish. As Cromwell said, “Put your trust in God, but keep your powder dry.” Hope isn’t strategy… action under threat is.

You must train your mind to see failure as fiction until the mission is done. Successful businessmen know that obsession without easy exit breeds results that calculation never will. So torch the fallback jobs, the sentimental attachments, and the half‑hearted ventures. Empty your harbor. Once your ships burn, every order becomes sacred, every move absolute.

Your Emotional Bank Account Is Everything: A man goes bankrupt in spirit long before he runs out of cash. The balance that truly collapses is internal: self‑belief, discipline, and self-esteem wired into you long before you dreamed of your first business. You learned your personal limits during childhood, from parents who meant well, but taught caution, not conquest. “Give me a child until he is seven,” Aristotle warned, “and I will show you the man.” Your first mentors were amateurs, yet you still let their fears manage your ambition. Forgive them, then overwrite your inner flaws. Rebuild that emotional ledger with deposits of courage and withdrawals of doubt. Every failure should fortify the account, not overdraw it. Babe Ruth understood it: ”it’s hard to beat a man who keeps swinging.”

Emotional solvency is the difference between growth and collapse under pressure. If you don’t love your own war, no one else will invest in it. Successful businessmen maintain the same ritual bankers do: daily auditing. What took your energy? What replenished it? You are the average of the five influences around you and if they can’t handle volatility, their personal debt becomes yours. So curate your psychology like capital. Withdraw from pity, deposit into conviction. Cashflow your confidence every morning before the market opens. When your emotional account stays liquid, you can fund any dream, even when the world declares you insolvent. Your emotional bank account let’s you build and snowball trust in yourself and your ability.

Pain Is the Entry Fee: You can suffer now, later or forever. No one is coming to save you. The entry price for significance is suffering endured in silence. Every man pays: some early in sweat, and the rest later in regret. The myth of an easy life is propaganda for spectators. Life is hard for the rich, the poor, and the useless alike… the only difference is how fast they rise after falling. To be human is to suffer. We all do. The successful businessman learns to metabolize pain into progress. As Epictetus said, “Circumstances don’t make the man, they only reveal him.” When bankruptcy crushes you, when female betrayal hits, when the floor disappears, your reaction is the empire’s audit. Cry, curse, smoke, drink… then move. The world does not pause because you’re dizzy. Responsibility is oxygen and self‑pity is carbon monoxide.

No man gets to outsource his resilience. The child from chaos, the addict, the bankrupt, each gets the same option: evolve or succumb. High‑performance men don’t deny their history, they use their past trauma as stepping stones. Every scar is another system debugged. The market doesn’t ask what hurt you, it asks what you learned. Churchill knew it: “Success is going from failure to failure without loss of enthusiasm.” So suffer now, deliberately, while you control the rhythm. Men who dodge discomfort, simply rent their future from those who embraced it.

Instinct Over IQ: Civilization has always overrated clever men. The salons of Europe overflowed with savants who could recite Euclid backwards yet couldn’t negotiate the price of bread. Meanwhile, men of unremarkable intellect: dockworkers, traders, miners, scrappy contractors, etc. quietly constructed fortunes large enough to make philosophers stammer. Business rewards the man who can read a room, not the man who can recite Laplace. The empire builders of history, men like John Jacob Astor or Samuel Crompton, were not prized for celestial intelligence; they were prized because they moved when others hesitated. Instinct, not genius, founded industries.The world does not compensate you for understanding the Pythagorean theorem… it compensates you for stepping into a negotiation with posture steady, voice unhurried, and the courage to make decisions while the timid wait for “more information.” High IQ can predict a storm, but instinct, well, that sails right into it and it arrives first at the next shore.

A man of instinct advances by reading signals others ignore: the flicker of uncertainty in a seller’s eyes, the fatigue in a founder’s voice, the tension in a partner’s pause. When such a man receives data, he does not drown in the spreadsheet, instead, he extracts direction from it: what to buy, whom to call, and which terms to press. The intellectual, paralyzed by his own brilliance, clutches notebooks like shields and misses openings that vanish as quickly as they appear. The instinctual businessman acts: he asks for the meeting, he proposes the structure, and he signs the letter of intent before the overthinker has completed his fourth analysis. This is why the marketplace belongs to those who err forward rather than theorize in circles. As Arthur Wellesley warned, “Action may be risky, but inaction is fatal.” A man does not need to be exceptional in IQ to build an empire; he needs the courage to step, the discipline to adjust, and the instinct to sense opportunity before the clever have finished debating its existence.

Passion Fuels Discipline: Passion is the spark, not the engine. It’s what keeps you going the extra mile, but your hear alone can’t carry the battle. You don’t need to love every inch of your work; you need to love winning. Plenty of men are obsessed with cars, but the only one who gets rich is the dealer who understands margin. The craftsman worships wood; the businessman sells the forest. Passion only matters when discipline runs out… when staying the course feels like punishment. That’s when genuine fascination keeps you upright while competitors quit from exhaustion. As Voltaire said, “Work keeps us from three great evils: boredom, vice, and need.” Purpose breeds passion, not the reverse.

Word of Mouth Lasts Centuries: The market does not always bend to the volume of a man’s advertising budget; history often mocks him. Tacitus noted that “men credit most what seems least rehearsed,” and no billboard has ever carried the quiet authority of a satisfied customer speaking without incentive. A single recommendation, whispered over coffee or exchanged across a dinner table, carries more force than millions spent on digital noise, because testimony feels like truth and advertising feels like plea. The successful businessman understands that reputation travels on foot, but it never tires. He recalls the Venetian glassmaker whose finest pieces were never displayed, only mentioned by patrons who feared being the last to possess them. He remembers the tailor whose name spread through London not by signage, but by the envy provoked when a duke entered court wearing his stitch. This is the mechanics of word of mouth: aspiration transmitted through another man’s pride. You cultivate it by delivering an experience so flawless that silence becomes impossible. You eliminate every point where disappointment could take root. You move through interactions with the calm precision of a man who assumes he will be quoted later. A referral is not luck… it is engineered inevitability.

Even The Best Businesses Sell Trash: The public imagines that excellence governs production, that every item leaving a factory bears the immaculate precision promised in its advertisements. Yet anyone who has studied industry from the inside knows a colder truth: even the most celebrated enterprises routinely release goods they know are flawed. The myth of “the perfect product” is a child’s fantasy; the marketplace is sustained by tolerance, not purity. Entire fleets of merchandise roll out bearing hairline defects, structural blemishes, or components that the engineers themselves warned against. Historically, vast empires of manufacturing have shipped wares with coatings known to erode, fittings prone to warping, and circuitry that misbehaved when stressed… each issue relegated to the service department as a future inconvenience rather than halted at the gate. The leadership class, trained in the arithmetic of scale, viewed such failures as statistical noise rather than moral offense. They knew the world would continue buying. They knew customers complain loudly but purchase quietly. And so the machinery kept running.

This habit predates the age of steel and microchips. Medieval foundries produced armor whose rivets were known to surrender after repeated blows. Glass‑grinders created telescopes with lenses so thin the scholars who bought them blamed themselves for the blurring. Celebrated clockmakers released mechanisms tuned just enough to pass their own demonstration, but incapable of maintaining accuracy in the hands of soldiers. In more recent ages, modern factories unveiled household marvels that were later herded into discreet recalls after executives discovered certain internal materials broke down faster than testing had suggested. There were periods when iconic devices paraded onto the market despite technicians muttering behind closed doors that a hinge would snap in cold weather, or that a seal would fail in humidity, or that an internal wire, placed too close to a heating element, would one day betray its owner. But revenue charts seduced decision‑makers and refinement gave way to speed. Marketing served as lacquer, hiding structural compromise beneath the glow of public anticipation. And, more often than not, enthusiasm outran accountability.

Recognizing this reality requires no bitterness, only maturity. The man who imagines industry is run by artisans lives in fantasy while the man who understands it is run by operational economists finally sees the field correctly. The goal is not to emulate the shortcuts but to read them as signals. A successful businessman inspects products with the same discipline Xenophon applied to terrain: searching for where the ground is softer than the map suggests, where the promises of the brand diverge from the truth of the materials, and where haste dressed itself as innovation. If you want to understand the machinery of commerce, study the flaws companies accept rather than the virtues they advertise. Those sanctioned imperfections reveal their incentive structures, their risk calculations, and their unspoken priorities. Modern consumer markets resemble the courts of antiquity: dazzling in public, compromised in private, and propelled forward by ambition more than purity. And the discerning observer knows that history’s most adored objects often carried hidden weaknesses known long before the crowds embraced them.

Selfishness Is Survival: Whoever condemned wealth simply lacked the courage to chase it. Money corrupts but it also clarifies. It reveals who you’ve always been and gives you the leverage to act on it. You can’t fix life’s problems with incense and idealism. Zen doesn’t pay the mortgage. If you want to influence the planet, stabilize your own orbit first. As Francis Bacon wrote, “Money is like manure: of very little use except it be spread.” First, acquire enough to spread. Every sermon against greed comes from someone on payroll; no one financed cathedrals by meditating. The rich worry about civilization because they can afford civilization. The poor debate philosophy over second notices. In the timeline of the universe, we are vapor. Your only rebellion against insignificance is the scale of your ambition.

So stop apologizing for wanting wealth. The world doesn’t need more broke saints, it needs competent successful businessmen who can buy solutions. Whether or not eternity remembers you is irrelevant… you’re here now, and power is the only oxygen worth inhaling. After all, cash doesn’t cheat death, but it reshapes the years between cradle and coffin. As Nietzsche said, “The will to power is the will to life itself.” Be selfish enough to live fully, earn shamelessly, and die having chosen everything on purpose. ”Money, not morality, is the principle commerce of civilized nations”, Thomas Jefferson.

Stop Seeking Constant Approval From Others: A man chasing applause is a man unfit for command. Approval is the cheapest drug ever sold, and most men are lifelong addicts… waiting for their father’s nod, their mother’s blessing, or the invisible crowd’s permission to begin their own lives. But successful businesses are not built by men who ask before they act. “The man who seeks to please all, pleases none,” wrote Fénelon. You don’t need parental validation to open a company, negotiate a contract, or sign away equity. The only approval you need is your own. Half of what men report to their families isn’t even sharing: the first sale, the small things… it’s all disguised as begging for reassurance. Eliminate those habits.

Surround yourself instead, with competence, aka your dream team: lawyers who examine your contracts, accountants who sharpen your numbers, advisors who elevate your judgment. Let skill, not sentiment, direct your path. And when doubt flickers, ask the only question that matters: “Does this company stand for something great to someone?” If the answer is yes, move. If the answer is no, rebuild. Your life is not a committee vote.

Control What You Can Crush: Marcus Aurelius whispered to himself before dawn: “govern the realm that answers to you, and let the rest fall to the winds.” Business is littered with professionals who exhaust themselves sermonizing to audiences that did not request enlightenment. Consider the tradesman who performs property inspections with the fastidious rigor of a medieval scholar: probing every beam, every bolt, and every structural fatigue as if he were deciphering the Dead Sea Scrolls. His clients may appreciate the thoroughness, but the real estate agents who depend on quick, frictionless closings will quietly exile him from their referral circles. He dreams of elevating the entire marketplace through exhaustive education, unaware that teaching the masses is an undertaking that swallowed empires far richer than his. The effort would drain his coffers long before it reshaped their comprehension. Even if he paced the rooftops delivering sermons about why excellence saves money in the long run, the market would continue rewarding speed over scholarship.

Consider the baker who insists on using butter instead of industrial oils faces the same impasse: the superiority of his craft does not rearrange the palate of the customer who has been raised on cheaper fat. He could lecture patrons on lipid chemistry, metabolic pathways, or the quiet treachery of seed‑based substitutes, and yet all he would earn is the reputation of a scold, not the profit of a craftsman. Behavioral economists like Herbert Simon would note that most buyers operate under “bounded rationality”: they choose what is familiar, convenient, and cheap… not what is finest. The successful businessman recognizes this and allocates his energy with the precision of a general mapping supply lines. He refines what lies within his command: the standard of his work, the clarity of his offering, the discipline of his pricing, and the rhythm of his communication. He does not squander seasons attempting to convert an indifferent market into a congregation. Instead, he constructs a fortress of efficiency and lets the world come to him on grounds he has chosen, not on battlefields where he bleeds for the privilege of being ignored. He does not focus on things in which he cannot change. Just like the customer, you cannot control your competitors, the emotions of others, the choices of your vendors, etc.

Deprogram Yourself: Every system you were raised in was designed to domesticate and docile you. From grade school to corporate cubicle, you were trained to obey, not to achieve. You learned to share crayons, stand in line, and fear failure… perfect habits for employees. Unless you descended from billionaire families or world-class Olympic athlete parents, you weren’t taught performance, you were taught external permission. You don’t need a degree to master commerce. You only need defiance, discipline and inspiration. Aristotle called habit “a second nature,” and that nature must now be burned. High‑performers redesign their software by questioning every inherited limit: morality, education, normality, even humility. Everything you call modesty is just fear wearing a polite suit.

Safety is the drug of mediocrity and it’s why there are more men than successful businessmen in the world. You were lied to about equality, fairness, and fairy tales where everyone shares. No one is sharing their yacht with you, no one is splitting the stocks. Nature rewards aggression disguised as grace. As Nietzsche wrote, “He who cannot command himself will be commanded.” The cure is revolt against programming, against inherited timidity, against every soft illusion sold to keep you predictable and non-competitive. Deprogramming is simply realizing you that have a choice.

Ethics Don’t Scale: It isn’t kindness that wins, as much as even I’d like that to be the case, it’s coordination, aggression, and the refusal to blink when the weak beg for fairness. The market doesn’t reward moral virtue, it rewards outcomes. The lion that hesitates to kill starves, no matter how ethical his roar. As Machiavelli warned, “It is better to be feared than loved, if you cannot be both.” Empathy beyond utility is self‑sabotage. Extend warmth only where reciprocity exists, otherwise, compassion becomes a tax on ambition. Morality is a social contract written by losers to protect themselves from winners. Dominance and clever deception are not defects, they are the default operating system of civilization. Look at empires, boardrooms, and elections: the throne goes not to the virtuous but to the strategic. Humanity organizes itself into hierarchies precisely because hierarchy works. The so‑called narcissist merely weaponizes biology better than the altruist armed with guilt. Nietzsche called morality “the instinct of the herd.” He wasn’t wrong. Your rise demands indifference; your fortune demands selective cruelty. You don’t have to be vicious, you simply can’t be overly sentimental. In business, empathy without calculation is treason against your own potential, and saints never owned skyscrapers.

Copy What Works: Innovation is a luxury bought with other people’s proven models. The fastest route to power is imitation. If a strategy feeds your competitor, eat from the same trough until you find a richer pasture. Success leaves receipts: landing pages, guarantees, warranty terms, marketing phrases/words, and pitch scripts, study them like sacred texts. As Sun Tzu wrote, “He who excels in solving difficulties does so before they arise.” Why reinvent tactics when others have already paid tuition in blood and bankruptcy? Copy their system, test their angles, and then compress time by removing their mistakes. The marketplace rewards speed, not originality. You can be the pioneer with arrows in your back or the general picking up dropped gold. Replication done intelligently is not theft… it’s evolution for profit.

Whatever It Takes: Be as tough as nails. Value has a blood price attached. Every man demands abundance, but few volunteer to make the down payment in pain. You can achieve almost anything… but only if you’re willing to lose almost everything first. Luxury, influence, beauty, control, etc. these are scarce precisely because they require years most men surrender to comfort. “To achieve great things, we must live as though we shall never die,” wrote de Montaigne, and he understood that ambition devours leisure by design. The rich enjoy more choices because they sacrificed choice itself early: cutting friends, comfort, and even sleep until freedom became residual income. Most call that obsession, history calls it destiny.

Sacrifice is the sorting mechanism of civilization. We can’t all own Lamborghinis or empires because most won’t bleed for them. Every hour in the gym, every dollar reinvested, and every temptation refused buys equity in the future. The lazy will claim to “want balance,” as if compromise ever minted wealth. Men who crave the extraordinary must surrender the ordinary. Cicero said, “For a man to conquer himself is the first and noblest of all victories.” Conquer appetite, comfort, distraction, and the trophies redistribute themselves automatically. The world doesn’t hand out prizes, it sells them to the highest sacrificer.

History is littered with men who slept on stone so they could one day dine on silver. Nikola Tesla worked in basements lit by flickering bulbs, living on borrowed meals while designing revolutions in his head. Andrew Carnegie began by scrubbing factory floors until his hands bled, long before steel bowed to his will. John Jacob Astor sold trinkets door‑to‑door in the cold like a wandering peddler before becoming America’s first multimillionaire. Such degradations do not diminish the businessman, they temper him. The weak imagine humiliation is fatal… the strong treat it as consecration. Sleeping on the floor, taking the lowest work, and enduring the jeers of men who will later beg for employment: these are not tragedies, they are the initiation rites of those destined to command. A man who refuses hardship forfeits greatness. A man who accepts indignity as tuition earns the right to dictate terms later.

Cold Hard Indifference: A man who builds anything of consequence must develop a strategic indifference so complete it becomes a form of armor. The timid businessman frets over whether his advertising appears “crass,” “loud,” or “beneath him,” and in doing so, he reveals what Marcus Aurelius despised: a soul governed by the audience, not by mission. The successful businessman, by contrast, understands that visibility is not vanity, visibility is survival. Every empire from Ashurbanipal to Andrew Carnegie expanded not through silence but through proclamation. The founder who hesitates to broadcast his creation condemns it to obscurity. He fears that a mass email appears inelegant, that a cold call feels uncouth, that repetition might offend delicate sensibilities, but this fear is simply cowardice wearing the mask of taste. The world does not reward invisibility. The world does not pay homage to the quiet. Markets move toward those who announce themselves with unapologetic force.

The successful businessman recognizes that criticism is the tax on momentum. You will collect entire nations of detractors before a single generation of loyalists emerges. A thousand unaccomplished onlookers will call your marketing crude, your design amateurish, your product “dead on arrival”… not because they have insight, but because your hustle reminds them of their own miserable stagnation. The fool allows such noise to slow his stride yet, the successful businessman treats it as proof of direction. When you dial the phone, do it with the posture of a man who has already accepted rejection as routine. You’re going to hear no a million times. When you send a bulk campaign, send it with the same detachment a general uses when he signals artillery fire. When you speak of your product, speak with the calm inevitability of a man describing an incoming tide. Never apologize for reach. Never dilute your presence to soothe the insecurities of the herd. Your duty is expansion, their pathetic duty is commentary. Let each man fulfill his role.

Simplicity Wins Because There Are No Grand Secrets: Stop overthinking everything. The complicated man is easy to beat. He’s literally trapped in his own ceremony. He believes he is just one more book, one more course away from solving all of his problems. Business mechanics aren’t mystical, they’re arithmetic and nerve. Pick up the phone, find the seller, close the deal. Everything beyond that is costume. Complexity seduces the weak because it excuses their inaction. They think success hides behind confidential algorithms or Ivy‑League formulas, it doesn’t. It hides in repetition, persistence, and audacity. Leonardo da Vinci wrote, “Simplicity is the ultimate sophistication,” and he was right: the cleanest path is usually the most brutal. You don’t need exotic mentors, theoretical valuations, or twenty‑slide forecasts. You need movement. Call the banker, sign the paper, cash flow the debt, exit, repeat. The kings of commerce didn’t find secrets. They mastered the obvious until it became nuclear. When you strip away the noise, victory is just disciplined execution performed loudly and forever.

Focus Equals Power: Laser beam focus is the silent multiplier of every ambitious business. Most founders stumble not from lack of intelligence, but from the absence of a disciplined hierarchy of priorities. When everything feels urgent, nothing becomes important, and the business drifts, pulled apart by competing impulses and digital noise. A successful businessman builds each day as a sequence of deliberate commitments: the first three tasks determine the quarter, and the quarter determines the year. Distraction is not an inconvenience, but a tax on his ambition. If you are checking trends, analyzing data as a timer waster, scrolling feeds, or losing an hour to idle errands, you are effectively surrendering strategy to whim.

Warren Buffett and Bill Gates were once asked to distill their success into a single word. Both wrote the same answer without hesitation: focus. They understood that attention is capital, and most entrepreneurs treat it like spare change. A leader who prioritizes rigor sets the cadence for the entire organization. When you decide that your time is sovereign, that entertainment, chatter, and personal indulgences must wai, the people around you begin to follow suit. A business aligned behind clear priorities accelerates, but a business led by a distracted mind fragments. Elite execution comes from eliminating the optional and amplifying the essential. Focus is not merely a habit… it is the primary operating system of high performance businessman.

Show Up Every Single Time: If your presence can be negotiated, then so can your authority. The super successful businessman does not rearrange his empire around birthdays, anniversaries, holidays, or whatever sentimental obligations soften lesser men. If your leg is broken, you drag it. If your life is on fire, you walk through the smoke. No one crowns a man who can be derailed by inconvenience. Reliability is rarer than capital, and power flows to the man who appears even when he shouldn’t. Robert Walpole said, “The world is governed more by appearance than realities.” He understood the secret: show up, and half the battle kneels before you. Most men miss destiny because it whispered while they were “recovering,” “resting,” or “not feeling 100%.” Show up, and you inherit the opportunities they abandoned.

Never whine about timing, fatigue, sickness, or chaos. No one cares anyways and the few who pretend to care cannot help you. You are not attending a meeting, you are asserting hierarchy. Your punctuality is a declaration of standards. Accountability is loyalty to your own throne. When you show up, every time, under any condition, the world learns the rule: your word is law.

Never Loose Your Fire: The tragedy of any business is not failure, it is the quiet, velvet‑lined death that follows early victory. Many of the men now seated atop their successful business began as wolves: lean, hungry, ungodly driven, and half‑mad with purpose. Then came their first triumph, and with it the most seductive assassin in commerce: comfort. They traded the hunt for the hammock, the battlefield for the boardroom portrait, and mistook temporary success for permanent success. As Schopenhauer warned, “man is only truly himself in the striving”; the moment he relaxes into his achievements, he begins to rot. Fortune does not tolerate stagnation; she abandons the man too timid to pursue her twice. The tycoons who built continents: Rhodes, Vanderbilt, Rockefeller, etc. understood this iron law: the engine must stay hot. A cold machine restarts poorly and with much more difficulty. Business achievement must be treated like momentum: always moving, always striking, and always being reinvested into new frontiers. To rest is to decay, but to doubt, is to dig your own grave.

Yet, an equally dangerous breed of men walk the opposite path: the man who attains great wealth in the pursuit of business, but cannot stomach the reflection staring back at him. He believes he has stolen his fortune from the gods and waits for lightning to strike him down. This psychology of unworthiness is as lethal as complacency. It drives men into bad deals, reckless expansions, unnecessary charity, or self‑sabotage disguised as humility. The market does not punish arrogance, rather, it punishes hesitation. As Nietzsche observed, guilt is simply “the instinct for cruelty turned inward.” In business, that cruelty becomes bankruptcy.

Choose Ruthless Mentors: A businessman intent on rising cannot rely on the counsel of the familiar, instead, he must seek those who have already carved a path through terrain he has yet to understand. The founder who chooses comfort over competence ends up mentored by the very mediocrity he hopes to escape. Many young aspirants reach instinctively for brothers, uncles, or agreeable acquaintances because these men cost nothing emotionally. They will nod, encourage, and spare feelings. But as Francis Bacon warned, “He that travelleth into a country before he hath some entrance into the language, goeth to school, and not to travel.” The wrong mentor teaches you the dialect of smallness. A mentor must stand at a height you wish to conquer, not a height you have already outgrown. If your circle consists of men who have never known anything beyond the wages of routine employment, that gravity becomes your own. In reality, their ceiling becomes your sky.

When you target someone of true stature, expect the first line of resistance to be administrative: office gatekeepers trained to repel tourists. The amateur asks for an appointment, the successful businessman asks the assistant when the man will next be within reach, then positions himself at the periphery of that orbit. One can meet a mentor in a lobby, a hallway, a luncheon, or even in the quiet perimeter of his driveway at dawn.. provided one carries the posture of intent, not desperation. The untrained announce themselves noisily, but the serious man waits like a hunter who understands the terrain.

Remember, proximity alone is useless without cadence. A mentor must be close enough for repeated contact, because mastery is learned through abrasion, not ceremony. Choose a guide you can reach frequently, the way a young courtier chooses a prince whose councils are held within riding distance, not in some far province requiring half a season’s travel. When you approach him, speak with a steady pace and your shoulders squared. Do not grovel, do not flatter, and above all, do not force him into embarrassment. A mentor who loses face in your presence will abandon you as swiftly as a general discards a soldier who breaks formation. Bring documents when needed: plans, financials, questions written with the precision of a man who respects time, and avoid the fatal error of asking for validation. A proper mentor is not there to soothe you… he is there to carve you. The wise apprentice invites correction with composure, while the fool resents the very discipline he claims to seek. And in this arrangement lies the oldest principle of statecraft: greatness is inherited not by blood, but by proximity to the right teacher.

Delegate to Killers: A kingdom is never built by the king alone, instead, it’s built by the killers he surrounds himself with. Your business isn’t defined by its industry, its product, or its pitch deck: it’s defined by who steps into the arena with you. Most companies morph into entirely different beasts than their founders intended. Yet, the ones that survive all share the same origin story: they chose assassins, not amateurs. Your team shouldn’t be obsessed with the destination, they should be loyal to the commander, to the culture, and to the standard. As Gaetano Mosca wrote, “Every ruling class is a ruling class because it organizes better than those it rules.” Organize your army for battle.

Stress-test every recruit. Put them under pressure and watch what cracks: ego, competence, or loyalty. When the stakes rise, give the biggest problems to the strongest minds, you’ll sleep well knowing your dream team is on watch. Surround yourself with the finest lawyers, accountants, and domain/industry experts you can afford, and demand performance ruthlessly. If they fail, replace them without ceremony. This is not a popularity contest, this is empire. Delegation: you free your hands for conquest while the machinery runs beneath you. The modern workforce worships being liked, you must worship being effective. Get the right people on your bus, for the right reasons, or crash alone trying to drive every damn wheel yourself.

Lead, Learn, Command: A leader worth following does not tiptoe through consensus. He walks with the unambiguous stride of a man who already knows the terrain others fear to map. His duty is not to soothe, but to illuminate… to strip away the comfortable fog and force his people to look directly at the contours of the battle ahead. Men do not rally around gentle ambiguity, they rally around the commander who defines reality before reality defines them. This is why the founder of Prussian command doctrine, Helmuth von Moltke, insisted that clarity under pressure was the highest form of discipline. When you articulate expectations with precision, posture straight, tone measured, and eyes fixed, you establish a mental perimeter in which only commitment can survive. A wise leader places the objective on the table with bluntness and demands the allegiance of those who would march toward it. There is no room for the hesitant. The timid general hides behind committees, the successful businessman advances into metaphorical gunfire because he understands that a man who does not move first forfeits the right to move at all. And yes, the world will accuse such a man of excessive fervor. They mistake conviction for spectacle. But when you stride into chaos first, you rob your subordinates of the excuse to falter.

The true leader is not the custodian of data but the architect of direction. He does not drown his team in minutiae, instead, he stands at altitude, surveying the landscape like a Renaissance prince guided by the counsel of thinkers more learned than himself. It is not expertise that grants him dominion, but the orchestration of expertise: the ability to gather sharper minds, bind them to a unified aim, and transform their disparate brilliance into coordinated firepower. Machiavelli observed that the most formidable rulers were those who could command men of superior intellect without fear of being eclipsed. The insecure leader hoards tasks and clings to control while the successful businessman delegates the micro and owns the macro. He gives specialists the freedom to maneuver while he defines the direction of the campaign. Your advisors become artillery, and your judgment becomes the barrel through which their force is projected. If you want to see a fool exposed, watch how he micromanages because he cannot inspire. The superior leader moves differently: he enters the room with the documents already aligned, the agenda carved into order, and the pace of speech steady enough to erase doubt. When he finishes speaking, no one wonders what to do… they wonder how soon they can begin.

Partnerships Go Sour: Partnerships are celebrated by romantics and regretted by strategists. A man dazzled by early harmony assumes a partner will amplify his ambition, but seasoned operators know the opposite is more common: shared ownership often decays into shared disappointment. A businessman who fails to carve an operating agreement at the very beginning, one that dictates authority, equity, exit rights, duties, and the terms of divorce, is a fool marching into battle without a map. The moment personal relationships sour, whether by breakup, marital ruin, or friendship fatigue, the business becomes collateral damage. I have watched husbands and wives destroy both their company and their marriage because they imagined affection could substitute for governance. A partner who sparkled in the beginning can later reveal himself as the laziest creature alive… a man who confuses camaraderie with contribution and expects others to compensate for his inertia. As Seneca warned, weak men lean hardest. Never assume a partner will carry the weight of your incompetence as you will only discover the depth of his resentment when it is too late.

Yet even with multiple partners, the disaster compounds. You may find yourself surrounded not by allies, but by a parliament of mediocrity: disagreements multiplying faster than progress, meetings turning into tribunals of wounded egos, and decisions caught in an interminable loop of vetoes and revisions. Instead of forward motion, you suffer what Pareto would call a “governance of paralysis.” It’s agility collapsing to near zero, ambition diluted by indecision, and the entire enterprise slowed by men more interested in leisure than conquest. Some want to travel, some want to celebrate imaginary victories, others want to debate trifles while the market marches past you. This is the hidden cost of partnerships: not betrayal, but stagnation. A partnership without discipline becomes a three‑legged horse. It doesn’t matter how noble the breed, because it will never win the race. Anticipate that time and success will eventually turn even friendship as partnership, into litigation.

Always Be Selling: Your survival depends on it. Every interaction, handshake, headline, and yes, even silence, is a transaction in progress. If you speak, you sell. If you breathe, you pitch. The timid men frame “sales” as sleaze because they’ve never understood persuasion as an act of mercy. It’s showing the lost where to spend and why. Everything you own came from someone’s mouth moving faster than yours. Disraeli said, “All power is a trust that must be sold to the people.” He was right… kings, presidents, preachers, founders, etc… it’s all commerce of conviction. So learn the rhythm: sell the sizzle, never the steak. Expose the wound, make them describe the pain, then offer the cure. You don’t describe ingredients, you sell relief. Detergent commercials know it, so did emperors before television existed.

If we’re all going to eat, someone has to hunt. That hunter is you. Your content, your meetings, your presence, etc. it’s all bait for belief. Sell even when you’re not selling: posture, tone, confidence, etc. Convince them their lives are smaller without your solution. You are the narrative’s engineer, the reason wallets open and markets move. Get over your fear of the pitch, because every single male on the planet does it. If they didn’t there would be no relationships, marriages or children being birthed. Business isn’t conversation… it’s continuous conversion.

Sell Through Emotion: The novice imagines men purchase with logic, as though the ledger were the throne of their decision. It is not. Desire moves the hand long before reason signs the document. David Hume remarked that “reason is the slave of the passions,” and though he penned it in an age of powdered wigs and candlelight, the sentence remains the most brutal truth in commerce. A man does not buy the object, he buys the version of himself he momentarily glimpses in its reflection. Emotion is what sells. And few institutions understand emotional leverage as well as the automobile dealership. The dealer knows that once a man grips the wheel and feels the machine respond beneath him during a test drive, affection begins its quiet takeover. Whether you are offering a carriage, a company, or a kingdom, the moment the buyer experiences the thing, appetite takes command. Don’t sell facts… sell the dream of ownership. Emotion opens the door, but certainty walks the buyer through it; speak with the inevitability of sunrise, for indecision in the seller breeds suspicion in the buyer

When a man arrives to inspect the business you intend to relinquish (or product you intend to sell), accept the brutal simplicity of human judgment: he appraises the terrain before he appraises the numbers. A room must command the senses before a salesman commands the mind. Temperature, sound, and lighting all conspire to shape his emotional posture. As Montesquieu warned, men are ruled by climates more than constitutions, the wise seller engineers both. Ensure the surroundings suggest vitality. The frayed flooring, the disordered reception, the idle murmur of an unled staff… each element becomes a silent indictment of your discipline, for as Voltaire observed, “style is the face of the mind,” and a neglected environment reveals a mind that has already withdrawn from command. Enforce presentation with monastic exactitude. Even ancient courts understood that ceremony strengthens conviction; the setting must behave like a private coronation: chairs aligned with military precision, documents laid as instruments of state, and the entire room framed as a transfer of power rather than a mere transaction. Rockefeller noted that the appearance of order was often worth more than order itself, and buyers are seduced not by the present, but by the visible trajectory of the enterprise. Show them not what the business is, but the line of march it’s prepared to take.